So many times, we hear the news talking about monopolies and companies seeking approval to purchase other companies or merge with others such as the AT&T and Warner merger approved by the courts. To help understand why the government regulates and approves some mergers or large companies, let’s start with defining key terminology.

Key Definitions:

Monopoly: A monopoly is characterized as a market structure in which there is a sole seller or producer that dominates a particular industry, thus inhibiting free-markets.Conglomerate: Conglomerates are a type of corporation where one larger parent company owns a controlling stake in several smaller companies who are free to conduct their own business. Conglomerates offer a benefit to the parent company as they are able to diversify their portfolios through the multitude of smaller companies. That all said, conglomerates can occur amongst both related and unrelated industries.

Sherman Antitrust Act: According to the Federal Trade Commission's website the Sherman Antitrust Act is "comprehensive charter of economic liberty aimed at preserving free and unfettered competition as the rule of trade." It also states "every contract, combination, or conspiracy in restraint of trade," is illegal, in addition to any "monopolization, attempted monopolization, or conspiracy or combination to monopolize."

What are Monopolies:

A monopoly is formed when one individual, company, corporation, or conglomerate rises to dominate a particular industry. Within this definition, four main types of monopolies emerge. These consist of the pure monopoly, monopolistic competition, the natural monopoly, and public monopolies.

A pure monopoly is the definition that comes to most people's minds when they hear the word monopoly. In this type of monopoly there is a singular seller for the goods/services within an industry. This seller is able to maintain their position as the industry powerhouse since there are high entry barriers.

The Sherman Antitrust Act in Modern Society:

In recent years many companies have faced antitrust suits under the Sherman Antitrust Act. Among these companies are big names such as Google, Apple, and Microsoft.

What are Monopolies:

A monopoly is formed when one individual, company, corporation, or conglomerate rises to dominate a particular industry. Within this definition, four main types of monopolies emerge. These consist of the pure monopoly, monopolistic competition, the natural monopoly, and public monopolies.

A pure monopoly is the definition that comes to most people's minds when they hear the word monopoly. In this type of monopoly there is a singular seller for the goods/services within an industry. This seller is able to maintain their position as the industry powerhouse since there are high entry barriers.

The next type of monopoly is a monopolistic competition. Monopolistic competition is when there are a variety of similar goods/services that serve as substitutes for what a company is offering, yet no exact match. Entering the industry is relatively easy and competitors set themselves apart with their prices as well as their marketing.

After that comes a natural monopoly. A natural monopoly is one that forms due to the difficult nature for competitors to enter into a certain sector. This can be due to various factors, including: high entry cost, knowledge imbalance within the industry, a lack of understanding of the specialized technology/materials, and any pre-existing patents.

Finally, there are the public monopolies. Public monopolies are allowed by the government as they provide vital goods and services to society, however, the government carefully monitors and regulates them.

Regardless of the type of monopoly, a few principles stay true. These principles are as follows: monopolies have both the potential to create unfair prices for consumers and the potential to prevent the establishment of competitors.

The Rise of Monopolies and Why they are Bad:Monopolies have long existed, they even date back to before the United States was born. A few of the most impactful monopolies in United States history include International Harvester, American Tobacco, Standard Oil, American Railway Union, U.S. Steel, and AT&T. Closely linked to the rise of large corporations came the emergence of powerful business tycoons. Perhaps some of the most notable tycoons are J.P Morgan, Cornelius Vanderbilt, Andrew Carnegie, and John D. Rockefeller.

Most of these monopolies and tycoons are from a time between the 1870s to 1900s. During this time there was such a surge of monopolies, along with political scandals and much more, that author Mark Twain dubbed the era as The Gilded Age. The Gilded Age is most notable for its rapid economic growth.

Monopolies contributed to the rapid economic growth of the United States during the late 19th Century. Monopolies also helped to further the commercialization of certain goods and services which benefited the American economy as a whole. Unfortunately, monopolies also came with a multitude of disadvantages.

Consumers grew aggravated with excessively high prices on necessary goods/services. This was caused by large corporations facing little to no competition within their industry. As such, they knew they could charge whatever price they desired. Similarly, competing businesses struggled in the marketplace as large corporations forced their competitors out of their industry.

As a result, the United States Congress passed the Sherman Antitrust Act in1890, which was the peak of the Gilded Age.

How Does The Sherman Antitrust Act Protect Against Monopolies

The Sherman Antitrust Act is a United States antitrust law that was codified in the U.S. Code Title 15. The act was passed by congress in 1890. The name “Sherman” was in dedication to its primary author Senator John Sherman. The act was written in order to address concerns by both consumers and competitors of large corporations. The act sought to eliminate monopolies and conglomerates through banning collusion and merging of companies to create monopolies to encourage fair competition and dismantle dictating corporations in the market.

The Sherman Antitrust Act is a law designed to promote free and fair competition within the free market. The law also states that any attempt to subvert this freedom via a “...contract, combination, or conspiracy…” is illegal. Lastly, the law states that any effort to monopolize, whether it be a simple conspiracy or a full blown monopolization (such as AT&T) is equally illegal.

There are three main sections to the Sherman Antitrust Act that all work to compliment one another and prevent monopolies. The first section clearly defines corporate behavior and then bans anything that may inhibit free and fair competition. Examples would be collision, price fixing, and purposeful exclusion of competitors to name a few. The second section addresses mergers, purchases, and firms that gain too much power thus allowing them to monopolize and the aftermath of these anti-competitive practices, and the third specifying that this law is applicable in the District of Columbia and all U.S. territories.

Illegal acts under the Sherman Antitrust Act that had no defense or justification became known as “per se” violations. Lawmakers enforce the Sherman Antitrust Act by creating strong penalties for those found in violation of it. Individuals can face up to a $1 million fine and/or serve a maximum sentence of 10 years in prison if found guilty. Corporations get slightly more complicated as they can experience a $100 million fine or double the amount the conspirators acquired from their illegal activities or double the amount lost by victims if the two latter options exceed the allotted $100 million.

Flaws within the Sherman Antitrust Act

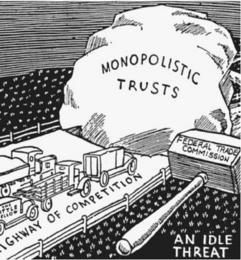

The Sherman Antitrust Act was a first attempt at creating more fair markets for consumers and competitors. It was initially met with great acceptance and appreciation by the public, yet it was soon discovered to have many flaws. The way the act was written left much to be desired. Lack of clearly defined terms led to extensive loopholes for corporations to exploit.

Terms such as monopoly, trusts, collusion, and “unreasonable” in the phrase unreasonable restrictions were left to interpretation making it difficult to prosecute infractions.

After the Sherman Antitrust Act

Following the Sherman Antitrust Act, Congress passed two more antitrust laws to compensate for the former’s shortcomings. These new laws were passed in 1914 and all three combined create the fundamental antitrust laws, which are used to regulate the market even today.

In 1914 Congress passed two Acts to strengthen anti-competition and provide a mechanism for enforcement. The first was the Federal Trade Commission Act. This Act had two purposes: to create the Federal Trade Commission (FTC) and then to give the FTC the power to enforce bans against “unfair methods of competition” and “unfair or deceptive acts or practices”. The FTC act was not inherently made to enforce the Sherman Act, however the act brings very similar cases into the scope of the FTC.

The second Act, the Clayton Act was made as a direct amendment to the Sherman Antitrust Act. This law was designed to block any mergers, acquisitions, or anything similar that may potentially create a monopoly and was more specific than The Sherman Act. The Clayton Act also allows any aggrieved parties in monopolization cases to sue. The Clayton Act had two amendments. The first being in 1936 and the second coming forty years later in 1976. The Robinson-Patman Act of 1936 banned merchants from conducting business in a discriminatory manner. The Hart-Scott-Rodino Antitrust Improvements Act of 1976 was designed to keep the federal government in the loop of any large mergers between corporations and companies.

Regardless of the type of monopoly, a few principles stay true. These principles are as follows: monopolies have both the potential to create unfair prices for consumers and the potential to prevent the establishment of competitors.

The Rise of Monopolies and Why they are Bad:Monopolies have long existed, they even date back to before the United States was born. A few of the most impactful monopolies in United States history include International Harvester, American Tobacco, Standard Oil, American Railway Union, U.S. Steel, and AT&T. Closely linked to the rise of large corporations came the emergence of powerful business tycoons. Perhaps some of the most notable tycoons are J.P Morgan, Cornelius Vanderbilt, Andrew Carnegie, and John D. Rockefeller.

Most of these monopolies and tycoons are from a time between the 1870s to 1900s. During this time there was such a surge of monopolies, along with political scandals and much more, that author Mark Twain dubbed the era as The Gilded Age. The Gilded Age is most notable for its rapid economic growth.

Monopolies contributed to the rapid economic growth of the United States during the late 19th Century. Monopolies also helped to further the commercialization of certain goods and services which benefited the American economy as a whole. Unfortunately, monopolies also came with a multitude of disadvantages.

Consumers grew aggravated with excessively high prices on necessary goods/services. This was caused by large corporations facing little to no competition within their industry. As such, they knew they could charge whatever price they desired. Similarly, competing businesses struggled in the marketplace as large corporations forced their competitors out of their industry.

As a result, the United States Congress passed the Sherman Antitrust Act in1890, which was the peak of the Gilded Age.

How Does The Sherman Antitrust Act Protect Against Monopolies

The Sherman Antitrust Act is a United States antitrust law that was codified in the U.S. Code Title 15. The act was passed by congress in 1890. The name “Sherman” was in dedication to its primary author Senator John Sherman. The act was written in order to address concerns by both consumers and competitors of large corporations. The act sought to eliminate monopolies and conglomerates through banning collusion and merging of companies to create monopolies to encourage fair competition and dismantle dictating corporations in the market.

The Sherman Antitrust Act is a law designed to promote free and fair competition within the free market. The law also states that any attempt to subvert this freedom via a “...contract, combination, or conspiracy…” is illegal. Lastly, the law states that any effort to monopolize, whether it be a simple conspiracy or a full blown monopolization (such as AT&T) is equally illegal.

There are three main sections to the Sherman Antitrust Act that all work to compliment one another and prevent monopolies. The first section clearly defines corporate behavior and then bans anything that may inhibit free and fair competition. Examples would be collision, price fixing, and purposeful exclusion of competitors to name a few. The second section addresses mergers, purchases, and firms that gain too much power thus allowing them to monopolize and the aftermath of these anti-competitive practices, and the third specifying that this law is applicable in the District of Columbia and all U.S. territories.

Illegal acts under the Sherman Antitrust Act that had no defense or justification became known as “per se” violations. Lawmakers enforce the Sherman Antitrust Act by creating strong penalties for those found in violation of it. Individuals can face up to a $1 million fine and/or serve a maximum sentence of 10 years in prison if found guilty. Corporations get slightly more complicated as they can experience a $100 million fine or double the amount the conspirators acquired from their illegal activities or double the amount lost by victims if the two latter options exceed the allotted $100 million.

Flaws within the Sherman Antitrust Act

The Sherman Antitrust Act was a first attempt at creating more fair markets for consumers and competitors. It was initially met with great acceptance and appreciation by the public, yet it was soon discovered to have many flaws. The way the act was written left much to be desired. Lack of clearly defined terms led to extensive loopholes for corporations to exploit.

Terms such as monopoly, trusts, collusion, and “unreasonable” in the phrase unreasonable restrictions were left to interpretation making it difficult to prosecute infractions.

After the Sherman Antitrust Act

Following the Sherman Antitrust Act, Congress passed two more antitrust laws to compensate for the former’s shortcomings. These new laws were passed in 1914 and all three combined create the fundamental antitrust laws, which are used to regulate the market even today.

In 1914 Congress passed two Acts to strengthen anti-competition and provide a mechanism for enforcement. The first was the Federal Trade Commission Act. This Act had two purposes: to create the Federal Trade Commission (FTC) and then to give the FTC the power to enforce bans against “unfair methods of competition” and “unfair or deceptive acts or practices”. The FTC act was not inherently made to enforce the Sherman Act, however the act brings very similar cases into the scope of the FTC.

The second Act, the Clayton Act was made as a direct amendment to the Sherman Antitrust Act. This law was designed to block any mergers, acquisitions, or anything similar that may potentially create a monopoly and was more specific than The Sherman Act. The Clayton Act also allows any aggrieved parties in monopolization cases to sue. The Clayton Act had two amendments. The first being in 1936 and the second coming forty years later in 1976. The Robinson-Patman Act of 1936 banned merchants from conducting business in a discriminatory manner. The Hart-Scott-Rodino Antitrust Improvements Act of 1976 was designed to keep the federal government in the loop of any large mergers between corporations and companies.

The Sherman Antitrust Act in Modern Society:

In recent years many companies have faced antitrust suits under the Sherman Antitrust Act. Among these companies are big names such as Google, Apple, and Microsoft.

The Sherman Antitrust Act Effects:

The Sherman Antitrust Act impacts society as a whole by allowing for more choices within a market, which allows better prices and options for consumers. It also allows individuals the opportunity to enter into the market and establish their own businesses with more ease. In theory, this minimizes the divide between the rich and the poor by limiting the amount of wealth and control over a sector a singular party can have. Competitive markets also enable people to build their own wealth through starting their own business.

Moreover, competitive markets give people the ability to decide how much they want to spend on a good/service as they can choose who they want to do business with. On top of that, competitive markets yield fairer prices which in turn benefits the consumer. This impacts my family, friends, and myself as most everything we do is bound by money and how much it costs to support that action or activity. The Sherman Antitrust Act paves the way for individuals, such as myself, to do what I love and use the goods/services I like at a reasonable cost.

Finally, the Sherman Antitrust Act affects my generation as people from my generation have (arguably) never had to live through the extreme negative consequences of a monopoly and its influence on the market.

Comments

Post a Comment